FCRA 2025: What Every NGO and Donor Must Know

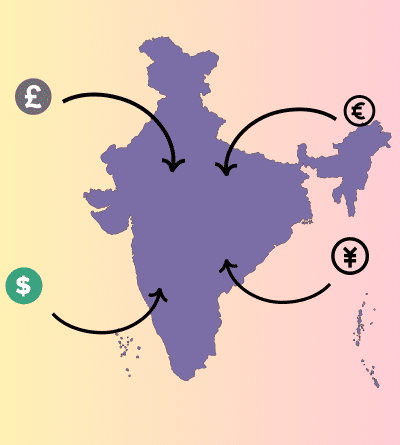

The Foreign Contribution (Regulation) Act (FCRA) plays a central role in regulating how Indian NGOs receive and use foreign funds. Over the years, the law has evolved to improve transparency and accountability. In 2025, the Ministry of Home Affairs introduced significant amendments to tighten compliance, enhance transparency, and safeguard national interests. These changes affect donors who contribute foreign funds and NGOs that receive and utilize them. Let’s explore what has changed and how both sides can adapt smoothly.

The Regulatory Foundation – FCRA’s Core Constraints

India’s regulation of foreign contributions is driven by a consistent sovereign objective: to ensure international funds do not compromise internal security or unduly influence domestic polity. This security-first approach is manifested through three core structural changes established in 2020 that remain the immutable law in 2025.

- Ban on Sub-Granting: Ending Intermediary Funding

The strict prohibition on the transfer of foreign contributions between FCRA-registered entities ended the long-standing practice of sub-granting. Before 2020, larger NGOs often acted as intermediaries, channeling international grants to smaller, local organizations. This ban cut the financial lifeline for numerous grassroots groups, severely disrupting the established consortium funding model.

- Administrative Cap Squeeze (50% to 20%)

The reduction of the cap on using foreign funds for administrative expenses, lowered from 50% to a maximum of 20% of the total foreign contribution received, places immense operational strain on organizations. This includes essential overheads like non-project staff salaries, rent, audit fees, and compliance costs.

- Mandatory SBI Account at NDMB

All foreign contributions must be received exclusively into a designated “FCRA Account” opened solely at the State Bank of India (SBI), New Delhi Main Branch (NDMB), located at 11, Sansad Marg, New Delhi-110001. This centralization ensures that every foreign transaction is instantly visible to the MHA through a single monitored chokepoint.

The 2025 Compliance Imperatives

Regulatory attention in 2025 has shifted beyond structural changes to focus on meticulous procedural compliance. The MHA has introduced specific advisories and requirements to enhance vetting and transparency across the board.

- The Renewal Rigor: The Four-Month Advisory

While the law requires an NGO to apply for renewal (Form FC-3C) at least six months before the certificate’s expiry date, recent MHA Public Notices strongly advise associations to file their renewal application significantly earlier—at least four months before expiry. This is due to the mandatory governmental inquiries required before renewal is granted, which often exceed the statutory 90-day processing period. A lapsed registration immediately prohibits an NGO from receiving or utilizing foreign contributions.

- New Documentation for Prior Permission

The MHA has implemented stricter vetting for new applicants seeking either registration or prior permission to receive foreign funds. Applicants must now submit several key documents to enhance transparency and alignment with global financial norms:

- Donor Commitment Letter: Applicants must provide a verifiable commitment letter from the foreign source, ensuring the amount pledged matches the donation stated in the application (Form FC-3B).

- Detailed Project Report (DPR): A comprehensive project report is required, clearly outlining activities, budgeting, and ensuring the expense structure strictly adheres to the 20% administrative cap.

- FATF Compliance Undertaking: Applicants must provide a formal undertaking to comply with the guidelines set by the Financial Action Task Force (FATF) regarding anti-money laundering and counter-terror financing norms.

- Affidavit on Past Utilization: Any entity with a previously expired or cancelled registration must also submit an affidavit detailing the receipts and utilization of foreign contributions during that period.

The Publication Constraint: Obtaining the ‘Not a Newspaper’ Certificate

A notable recent clarification introduces significant compliance requirements for foreign-funded NGOs involved in communications. Foreign-funded organizations engaging in publication activities are now restricted from publishing newsletters or news content. To comply with regulations that restrict foreign influence in domestic media, affected NGOs must obtain and submit a ‘Not a Newspaper’ certificate from the Registrar of Newspapers for India (RNI). This mandate directly impacts organizations specializing in research and policy dissemination, requiring regulatory compliance related to their communication strategy.

The NGO Action Plan: Maintaining Continuity and Compliance

For NGOs, uninterrupted operation requires disciplined adherence to financial limits and proactive procedural management:

Maintaining the FCRA Banking Structure:

NGOs must meticulously manage the mandated dual account system:

- Designated FCRA Account (NDMB): This account is mandatory and is used only for the receipt of foreign contributions. No local funds or expenditures can be processed through this account.

- Utilization Account(s): Funds must be transferred from the Designated FCRA Account (NDMB) to these Utilization Accounts—which can be opened at any scheduled commercial bank for the purpose of keeping and spending the foreign contribution.

Action on Administrative Costs:

Compliance with the 20% cap requires sophisticated financial planning:

- Rigorous Documentation: Maintain highly granular accounting records that rigorously distinguish between administrative expenses and direct program utilization. Costs must be clearly traceable to a program objective to justify classification as a direct program cost.

- Reclassification Strategy: Where legally permissible and supported by documentation, reclassify personnel or operational costs that directly benefit a project as direct program costs rather than administrative overhead.

- Prior Approval for Excess: If internal projections indicate administrative costs will unavoidably exceed 20%, the NGO must submit a formal application to the Central Government requesting prior approval for the excess expenditure. Operating beyond the cap without approval is a high-risk violation.

The Donor’s Playbook: Managing Grants and Due Diligence

For donors supporting Indian NGOs, the evolving FCRA landscape underscores the critical need for thorough vetting of partnerships. It’s essential to collaborate with organizations that uphold transparency, maintain a solid compliance record, and deliver meaningful outcomes. This is where HelpYourNGO can be your trusted ally. Our robust vetting processes ensure that you partner with credible NGOs, enabling you to make informed decisions and direct your contributions toward initiatives that create lasting value and align with your philanthropic goals.

Action on Grant Restructuring:

The elimination of the scalable intermediary (re-granting) model requires funders to adopt new approaches:

- Direct Grant Model: Donors must invest resources to identify, vet, and contract directly with smaller, grassroots organizations. This significantly increases the donor’s administrative and due diligence workload.

- Service Contract Model: Donors can legally utilize large Indian NGOs as service providers or consultants (e.g., for technical assistance, monitoring, or auditing) to support direct grassroots grantees. Payments for these specialized services are classified as commercial receipts or service fees, which fall outside the definition of a foreign contribution intended for re-granting, thereby circumventing the ban.

Action on Enhanced Due Diligence (Donor Checklist):

Donors are legally responsible for ensuring that their contributions fully comply with all Indian laws.

- FCRA Status Check: Verify the recipient NGO’s FCRA registration validity, confirm they have proactively applied for renewal, and check for any recent cancellations or rejections, which prohibit the utilization of funds.

- Budgetary Compliance: Scrutinize the proposed budget to ensure strict adherence to the 20% administrative expense cap. Funders should ask for detailed cost breakdowns to confirm administrative costs are classified correctly.

- Banking Verification: Confirm that the remittance instructions direct funds only to the recipient’s Designated FCRA Account at the specific SBI NDMB branch (Branch Code 00691). Remitting funds to any other account for receipt purposes is a regulatory violation.

- Reporting Review: Review the NGO’s publicly available quarterly and annual reports (Form FC-4) to track fund receipt, source, and utilization.

Final Takeaway

For NGOs, the focus now must be on professional bookkeeping, proactive compliance, and clear communication with donors. For donors, it’s about understanding the new landscape and aligning their giving with compliant NGOs to ensure their support achieves the intended social impact without legal risks.

By working together and planning ahead, both sides can ensure that genuine social work continues unhindered while maintaining full legal compliance.

Check out our latest blogs here: